A few days before Black Friday and a few weeks before Christmas, a new yet another e-commerce service is born, accessible for now only from the United States and only from smartphones and where everything costs less than 20 dollars

Born to compete with Temu and Shein, to surprise those who have not been surprised by the rock-bottom prices with home delivery in a couple of weeks, Amazon Haul comes straight from the United States.

This new virtual storefront promises to redefine affordable shopping, offering a line of fashion, home, lifestyle, and electronics, among other categories, with the bold promise of “everything under $20“. Jeff Bezos‘ retail giant seems to stop at nothing to try and stem the fast rise of its Chinese rivals. But do we need this, really? Not quite.

The process in which Amazon Haul functions is similar to its more conventional channel, though it has an apparent purpose of trying to push “affordability” that’s been set by various Chinese e-commerce platforms. Realistically, these often equate to poorly made and disposable items.

How Amazon Haul works

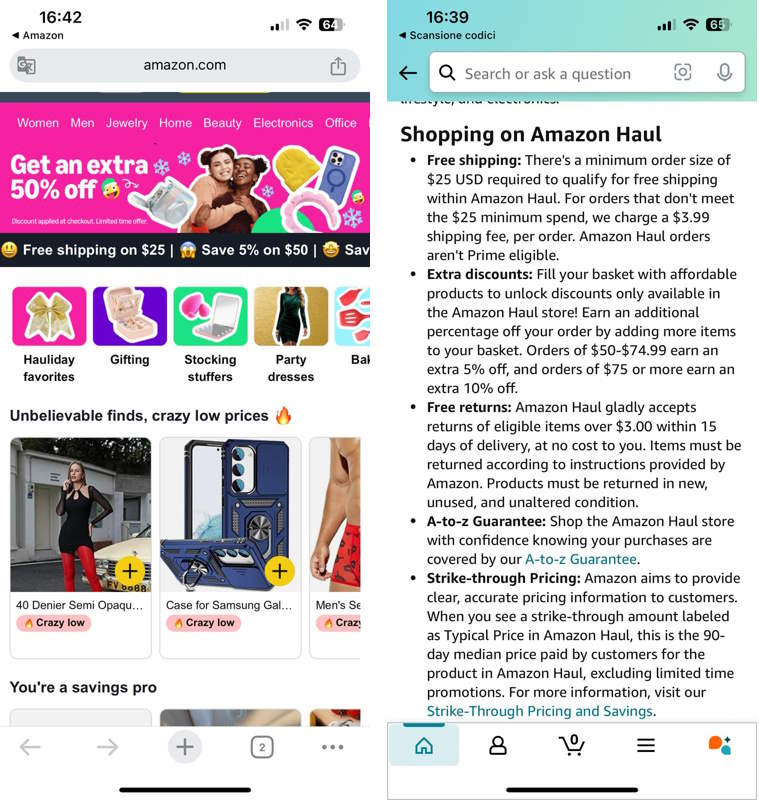

Still in beta for a small subset of US users, Haul is accessible from within Amazon’s mobile apps and website.

Like Temu and Shein, Haul sells a raft of products for less than $20, often falling to $10 or even $1. Shoppers add their selected items to the cart and proceed to checkout, enjoying free shipping on orders over $25; otherwise, there’s a $3.99 fee. Discounts sweeten the deal further: 5% off orders over $50 and 10% off orders exceeding $75.

While it is not as light-speed as standard Amazon Shopping deliveries, the items arrive in a couple of weeks. Returns come free, and customers can change their minds on purchases just like on the regular platform within 14 days.

@GreenMe

Is Amazon Haul a real threat to Temu and Shein?

In less than a decade, Chinese e-commerce platforms have turned the U.S. retail landscape on its head. According to a recent report by Salesforce, apps such as Temu, Shein, TikTok Shop, and AliExpress are projected to account for one in five holiday purchases. In that process, these sites have gone from niche players to challenging Amazon.

For many, Haul represents Amazon’s counterattack against this trend, offering “crazy prices” and “unbelievable finds.” Marketing campaigns abound with emojis—rockets, flames, and shocked faces—highlighting the platform’s playful approach.

From a business perspective, Haul is Amazon’s answer to how companies have been undercutting its prices by shipping products directly from Chinese vendors.

According to data from Appfigures, Temu is currently the most popular app amongst US users aged 18-24 years, with close to 42 million downloads between January and October 2024. Shein comes second, with about 15 million downloads.

Haul arrives at a peculiar moment for global trade. With deep economic ties to China, Amazon has long grappled with how to counter foreign e-commerce platforms. Its response coincides with two significant political developments:

Reforms by the Biden Administration: Proposed reforms that narrow what’s known as de minimis shipments, which exempt low-value items from duties and import taxes, could affect platforms like Temu and Shein. Changes, particularly on apparel, could go into effect as early as December.

Trump-Era Trade Policies: The new administration has pledged wider tariffs, particularly on Chinese imports. While these might hurt Haul, they would also knock the props out from under Temu and TikTok Shop. But wide-ranging tariffs could result in sharp price increases for many items sold on Amazon.

Global regulatory scrutiny continues to ramp up. The European Commission recently placed the likes of Temu and Shein under the Digital Services Act, or DSA, amid growing unease with platforms that have come to sell mass-produced, ultra-cheap goods.

Final thoughts: is Amazon Haul worth It?

At its core, Amazon Haul seems like just another avenue for purchasing an increasingly globalized inventory of unbranded, slow-shipping trinkets. While it might entice bargain hunters, it also raises questions about the long-term sustainability and quality of such a shopping model.